Delicious tax savings! Start making hometown tax donations

table of contents

Hello, this is Sakashita from Beyond

Have you started making hometown tax donations?

Hometown tax donations are gaining more and more attention every year, but do you know what they are?

This time, we will briefly introduce the mechanism and appeal of hometown tax donations!

What is hometown tax?

Hometown tax is a "donation" system to local governments

Strictly speaking, hometown tax payment is not a tax payment, but a "donation" to the local government you want to support

This system allows you to receive tax deductions according to your donations

There are no complicated procedures required, and you can also specify how your donation will be used

Some local governments offer local specialties as "thank you gifts," allowing you to choose the item you want

It's a very attractive system that many people use every year!

Three attractive points

There are three attractive features of hometown tax donations!

1. You can get tax deductions!

The amount donated is tax deductible, so the actual cost is only 2,000 yen

The remaining donation will be refunded from that year's income tax and deducted from the following year's resident tax

2. Receive local specialty products!

As a thank you for your donation, you will receive local specialties from the local government

3. You can donate to your favorite local government!

You can choose where to donate and how the money will be used, so you can donate to any prefecture, city, town, or village you like across the country

You can contribute to the town you live in or the local government you love and help develop your community

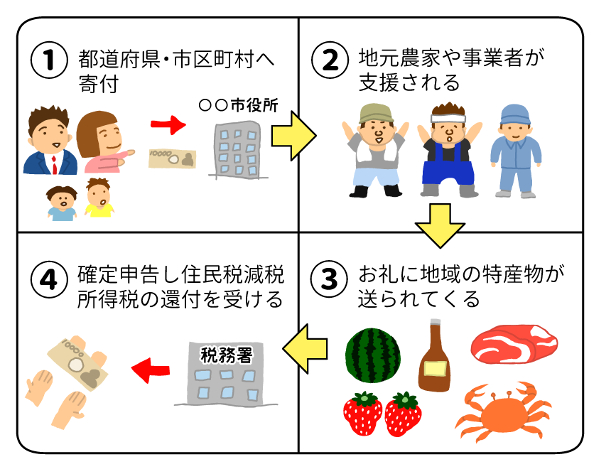

How donations work

We will briefly explain the process of hometown tax donations

- Choose the local government you want to donate to and make a donation

- Local farmers and businesses are supported

- Gifts and receipts will be delivered

- By filing a tax return, you can receive a reduction in resident tax and a refund of income tax

The flow is something like this!

Your gift will arrive in just a few weeks at the earliest

However, for popular items, you may have to wait several months!

Be careful about the amount you donate!

Hometown tax donations allow you to choose your favorite local government and thank-you gifts

It is a good system that also reduces taxes

I hope you understand

"Make more donations and lower your taxes!"

For those who think so!!

There is something to be careful about here!

Hometown tax itself is a donation that can be made freely, as it does not require tax payment

So you can donate as much as you want!

However, there is a maximum amount that can be deducted from your taxes depending on your annual income!

The upper limit varies depending on salary income (annual income) and family composition, so be sure to check in advance!

summary

・If you don't make a hometown tax donation, you'll actually be missing out!!

Your donation will be returned as a tax deduction!

・You can donate directly to local governments!

-Please note that there is a limit to the amount of donation that can be deducted!

Hometown tax donations a low-risk way to save on taxes!

First, try it out and experience the joy of receiving a gift

Popular local products tend to sell out quickly as the end of the year approaches, so we recommend choosing yours early!

Hometown tax donations have benefits for both the donor and the local government that receives the donation

Please check the conditions and enjoy making the most of hometown tax donations

I hope that more people will use hometown tax donations in the future, leading to greater revitalization of local communities

0

0