Easy to understand! What is the purpose of year-end tax adjustment?

table of contents

Hello, this is Sakashita from Beyond Co., Ltd

There's only a little time left this year!!

I'm sure you're still busy at work as we approach the end of the year, but have you submitted your year-end tax adjustment this year?

If you work for a company, you have to do year-end tax adjustments every year!

Although you may be asked to fill out required information on documents, many people may be wondering, "Why is this necessary?"

At first, I didn't really understand why I was submitting it

This time, we've put together a summary of the year-end adjustment system that even those who don't know much about it can understand!

What is "withholding tax" before year-end adjustment?

Income tax issues

In Japan, a tax called "income tax" is levied on the income of individuals who work

Income tax is subject to a self-assessment system, which means that taxpayers themselves must calculate the amount of tax due and file a final tax return to pay the tax. However, if salaried workers, part-timers, and other employees across Japan were to file returns all at once within a limited period, the tax office would be overwhelmed and unable to process them all. (It is said that if taxes were collected from individual taxpayers, it would be difficult to recover tax evasion and other cases.)

Withholding tax is when a company pays taxes on your behalf

Therefore, in Japan, when an employer such as a company pays salaries or bonuses, they deduct "income tax" from the salary or bonus in advance, and the company holds the money and pays it in one lump sum on behalf of the employee

This system is called "tax withholding."

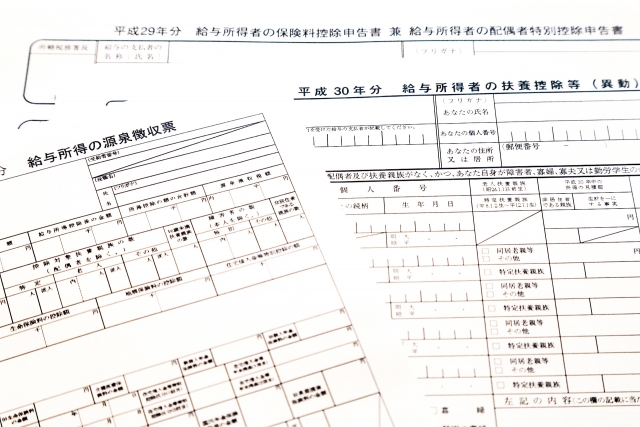

What exactly is "year-end adjustment"?

Problems with withholding tax

If you work for a company, your company will pay income tax on your behalf through withholding tax, but there are problems with this method

Income tax is levied on income earned between January 1st and December 31st of that year, while withholding tax is deducted from each monthly salary

In other words, you are paying taxes in advance before you even know your income for the year!

Therefore, the amount of income tax withheld each month is a rough estimate and is deducted in excess of the amount required

There are deductions for income tax

Also, if you paid life insurance premiums or earthquake insurance premiums during that year, or if you got married,

There is something called an "income deduction" that reduces your tax, so you end up paying more than the income tax you should be paying!

Adjusting for discrepancies = Year-end tax adjustment

As mentioned above, this is included to some extent in the calculation, but it is not possible to calculate an accurate tax amount based on each individual's circumstances, so at the end of the year (at the end of the year), the exact tax amount must be recalculated and adjustments made, such as refunding the difference with the income tax withheld each month, or collecting additional tax if it is insufficient

This is called "year-end adjustment"!

summary

・Anyone who receives any income during the year (January to December) must pay income tax

-In reality, taxpayers are supposed to file their own tax returns, but if you work for a company, the system in which your company can do it for you is called withholding tax!

If the amount of withholding tax is more than the income tax amount determined at the end of the year, the difference will be refunded! On the other hand, if it is insufficient, additional tax will be collected!

・Your income tax amount will be lower if you have dependents! Also, if you pay life insurance or earthquake insurance premiums, your tax will be reduced through income deductions, so be sure to check in advance!

・Year-end adjustment is the procedure for getting a refund for overpaid income tax!

Have you learned from this article why year-end tax adjustments are performed?

I hope this article helps you understand a little bit!

I haven't yet written about the details of how to write about year-end adjustments and withholding tax, so I'd like to write about it again on my blog!

0

0